Motor Vehicle Cost Base Elements . as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. (2) the first element is the total of: To calculate the taxable value of car fringe benefits under the statutory formula method,. Money paid or property given for the cgt. to work out the cost base of a cgt asset yourself, add these 5 elements: statutory formula method. depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. 5 elements of the cost base. I've got a quote for car purchase and it has various components: (a) the money you paid, or are required to pay, in respect of *.

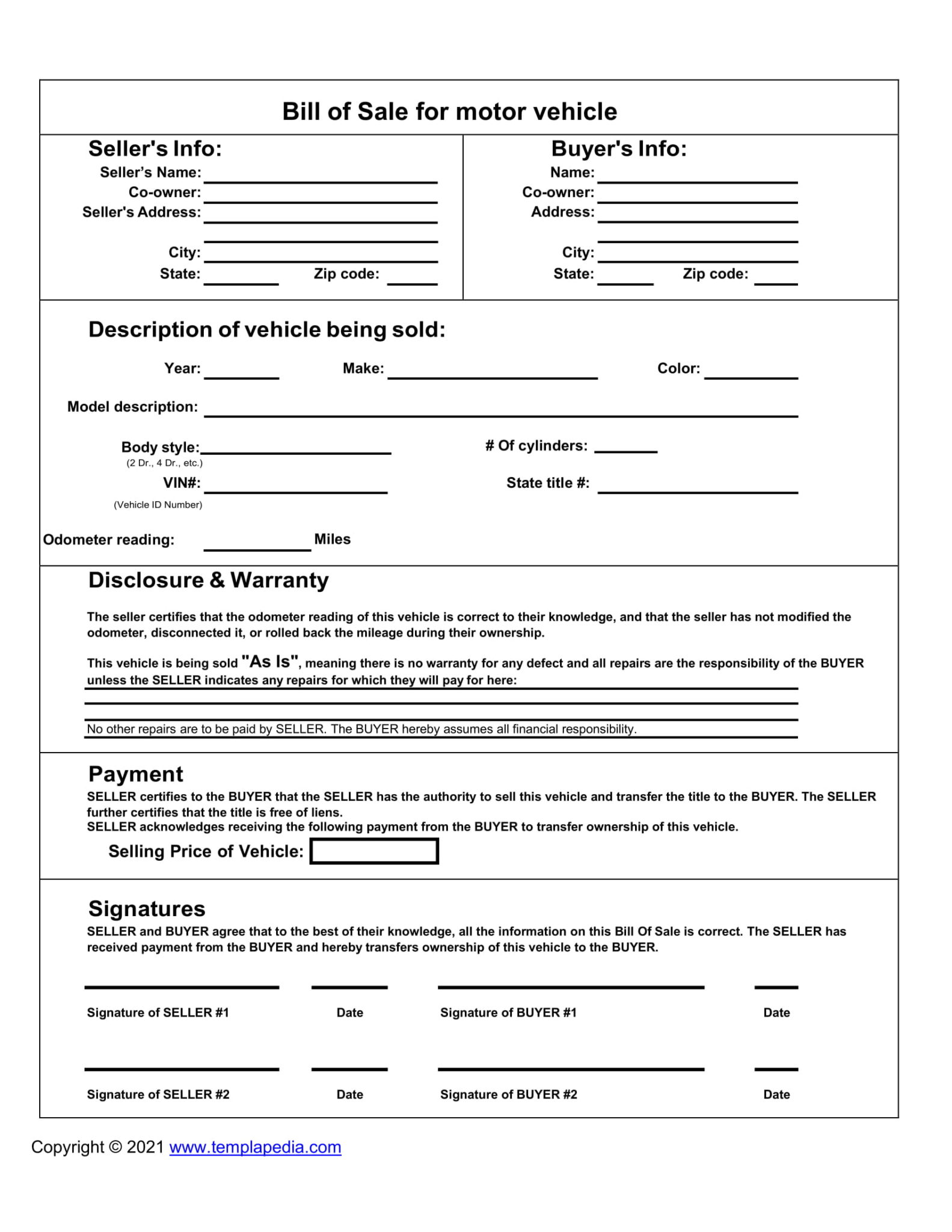

from templapedia.com

(2) the first element is the total of: as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. I've got a quote for car purchase and it has various components: statutory formula method. depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. to work out the cost base of a cgt asset yourself, add these 5 elements: To calculate the taxable value of car fringe benefits under the statutory formula method,. Money paid or property given for the cgt. 5 elements of the cost base. (a) the money you paid, or are required to pay, in respect of *.

Motor Vehicle Bill of Sale Template

Motor Vehicle Cost Base Elements statutory formula method. I've got a quote for car purchase and it has various components: to work out the cost base of a cgt asset yourself, add these 5 elements: 5 elements of the cost base. Money paid or property given for the cgt. statutory formula method. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. (a) the money you paid, or are required to pay, in respect of *. (2) the first element is the total of: To calculate the taxable value of car fringe benefits under the statutory formula method,.

From www.youtube.com

Chapter 1 Elements of Cost (Part 1) YouTube Motor Vehicle Cost Base Elements To calculate the taxable value of car fringe benefits under the statutory formula method,. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. I've got a quote for car purchase and it has various components: 5 elements of the cost base. . Motor Vehicle Cost Base Elements.

From markets.businessinsider.com

Here's how Tesla's Model 3 stacks up against the competition (TSLA Motor Vehicle Cost Base Elements 5 elements of the cost base. depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. (a) the money you paid, or are required to pay, in respect of *. I've got a quote for car purchase and it has various components: Money paid or property given. Motor Vehicle Cost Base Elements.

From www.weavecp.com

Weave Motor Vehicle Cost Base Elements Money paid or property given for the cgt. (2) the first element is the total of: statutory formula method. 5 elements of the cost base. I've got a quote for car purchase and it has various components: (a) the money you paid, or are required to pay, in respect of *. depreciation of most cars based on. Motor Vehicle Cost Base Elements.

From slideplayer.com

Launch Vehicle Economics Worked Examples ppt download Motor Vehicle Cost Base Elements as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. statutory formula method. 5 elements of the cost base. (2) the first element is the total of: To calculate the taxable value of car fringe benefits under the statutory formula method,. . Motor Vehicle Cost Base Elements.

From exogqjcks.blob.core.windows.net

Motor Vehicle Cost Base Fbt at Matthew Williams blog Motor Vehicle Cost Base Elements as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. (a) the money you paid, or are required to pay, in respect of *. Money paid or property given for the cgt. To calculate the taxable value of car fringe benefits under the statutory. Motor Vehicle Cost Base Elements.

From dphengg.com

Motor Base DPH Engineering Motor Vehicle Cost Base Elements (2) the first element is the total of: Money paid or property given for the cgt. to work out the cost base of a cgt asset yourself, add these 5 elements: To calculate the taxable value of car fringe benefits under the statutory formula method,. depreciation of most cars based on our estimates of useful life is 25%. Motor Vehicle Cost Base Elements.

From www.slideserve.com

PPT Chapter 4 Cost Control and Budgeting PowerPoint Presentation Motor Vehicle Cost Base Elements I've got a quote for car purchase and it has various components: statutory formula method. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. depreciation of most cars based on our estimates of useful life is 25% per annum on a. Motor Vehicle Cost Base Elements.

From www.slideserve.com

PPT Chapter 4 Cost Control and Budgeting PowerPoint Presentation Motor Vehicle Cost Base Elements To calculate the taxable value of car fringe benefits under the statutory formula method,. depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. statutory formula method. 5 elements of the cost base. (2) the first element is the total of: as the car limit. Motor Vehicle Cost Base Elements.

From www.semanticscholar.org

Table 1 from Launch Vehicle Cost Engineering and Economic Motor Vehicle Cost Base Elements statutory formula method. to work out the cost base of a cgt asset yourself, add these 5 elements: To calculate the taxable value of car fringe benefits under the statutory formula method,. 5 elements of the cost base. as the car limit only apples to the first element as per the legislation, and stamp duty is. Motor Vehicle Cost Base Elements.

From www.slideserve.com

PPT Chapter 4 Cost Control and Budgeting PowerPoint Presentation Motor Vehicle Cost Base Elements statutory formula method. To calculate the taxable value of car fringe benefits under the statutory formula method,. to work out the cost base of a cgt asset yourself, add these 5 elements: depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. as the car. Motor Vehicle Cost Base Elements.

From www.studocu.com

MINI TEST 2 Gụbvb Island Transport Vehicle Cost Comments Example Motor Vehicle Cost Base Elements to work out the cost base of a cgt asset yourself, add these 5 elements: as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. statutory formula method. depreciation of most cars based on our estimates of useful life is 25%. Motor Vehicle Cost Base Elements.

From www.transpoco.com

Fleet Cost Management (TCO) Motor Vehicle Cost Base Elements (a) the money you paid, or are required to pay, in respect of *. Money paid or property given for the cgt. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. depreciation of most cars based on our estimates of useful life. Motor Vehicle Cost Base Elements.

From drivinginsights.co.nz

Tips for optimal vehicle replacement timing Driving Insights Motor Vehicle Cost Base Elements (2) the first element is the total of: 5 elements of the cost base. to work out the cost base of a cgt asset yourself, add these 5 elements: depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. (a) the money you paid, or are. Motor Vehicle Cost Base Elements.

From www.reddit.com

Cost structure of an BEV vs ICE Vehicle r/electricvehicles Motor Vehicle Cost Base Elements 5 elements of the cost base. to work out the cost base of a cgt asset yourself, add these 5 elements: depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis (or. Money paid or property given for the cgt. statutory formula method. I've got a. Motor Vehicle Cost Base Elements.

From space.stackexchange.com

economics Cost breakdown of Delta IV Heavy launch Space Exploration Motor Vehicle Cost Base Elements To calculate the taxable value of car fringe benefits under the statutory formula method,. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. to work out the cost base of a cgt asset yourself, add these 5 elements: 5 elements of. Motor Vehicle Cost Base Elements.

From www.slideserve.com

PPT Chapter 4 Cost Control and Budgeting PowerPoint Presentation Motor Vehicle Cost Base Elements I've got a quote for car purchase and it has various components: to work out the cost base of a cgt asset yourself, add these 5 elements: Money paid or property given for the cgt. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as. Motor Vehicle Cost Base Elements.

From www.slideserve.com

PPT Chapter 4 Cost Control and Budgeting PowerPoint Presentation Motor Vehicle Cost Base Elements I've got a quote for car purchase and it has various components: 5 elements of the cost base. Money paid or property given for the cgt. statutory formula method. as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. (2) the first. Motor Vehicle Cost Base Elements.

From www.slideserve.com

PPT Chapter 4 Cost Control and Budgeting PowerPoint Presentation Motor Vehicle Cost Base Elements I've got a quote for car purchase and it has various components: as the car limit only apples to the first element as per the legislation, and stamp duty is recognised by the ato as a second. To calculate the taxable value of car fringe benefits under the statutory formula method,. 5 elements of the cost base. . Motor Vehicle Cost Base Elements.